My Investing Thesis [Work-In-Progress]

How do you make money on the internet? According to an overused saw, it’s the 3 Ps: pills, porn, and poker.

As I quoted Vlad Zamfir in issue 1:

- “There’s still technical problems. It doesn’t scale. It’s not efficient. It’s not secure. It sucks, basically. It’s shitty technology.”

Right now, dapps struggle to make it “easy enough” for non-technical end users. The Zamfir quote is not entirely about end users, but it is applicable. Many are hard at work to abstract away the difficulty for end users to the point that dapp users don’t realize they are using Ethereum. However, that day is far away.

So what kinds of things have motivated potential customers willing to jump through hoops? Often things at the margin of society.

SGD. I generalize the 3 Ps as SGD (like the algorithm): sex, gambling, drugs.

Sex. I shudder to think what sex-related apps need censorship-proof decentralization, but I haven’t heard of anyone building those on Ethereum.

Drugs. Silk Road paved the way for Bitcoin’s (relative) success, though it seems like peer-to-peer marketplace OpenBazaar (ie, not on Ethereum) will likely fill this niche. To date, I’ve been surprised at the dearth of Ethereum dark markets.

Gambling seems like a fairly natural fit for Ethereum’s early stages. Even better if we can use gambling for societal good.

Did I say Gambling? I meant Finance.

The difference between gambling, trading, investing, hedging, insurance etc etc is…?

Largely semantic. It wasn’t that long ago that stock markets were considered gambling.

Speaking of finance…

Banks and Ethereum

CONTEXT:

– John Whelan, leader of Banco Santander’s blockchain group

Two big announcements this week

- UBS, Santander, Deutsche Bank, BNY Mellon and ICAP announced Clearmatics’ “utility settlement coin” which is a token that participating banks will use to try to reduce counterparty risk using a permissioned blockchain. Put differently: the banks will keep a private blockchain between themselves using a token that they can exchange for cash. This will reduce much of the cost associated with “back office” functions. Coverage: Reuters, Financial Times

- R3CEV filed for a patent. You can read their non-technical white paper. Wall Street Journal: “Concord resembles Ethereum … [b]ut it is tailored expressly for financial institutions.” Over 60 banks, including Goldman, JPMorgan, etc are participating in the project.

- Key differences between R3 CEV and Ethereum as I understand them from white paper: (1) no token, (2) code is explicitly subservient to existing governmental law and regulations, (3) private, (4) transactions are independent of each other (stateless), (5) financial contracts only.

- Key differences between R3 CEV and Ethereum as I understand them from white paper: (1) no token, (2) code is explicitly subservient to existing governmental law and regulations, (3) private, (4) transactions are independent of each other (stateless), (5) financial contracts only.

Further reading: Vitalik on private blockchains in August 2015. Ethereum developer Bob Summerwill on Ethereum Everywhere

MY TAKE: Private chains using Ethereum-like technology can only be a good thing, even if they don’t run on the Ethereum blockchain.

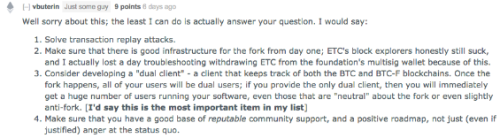

Vitalik’s candid assessment of the fork that almost no one has seen

Vitalik was asked by someone who wants to fork BTC what lessons they should learn from the ETH fork. Almost no one has seen Vitalik’s comment in response because the post got deleted.

A few observations:

- If you read between the lines, Vitalik’s assessment shows that he’s pretty candid with himself that the fork did not go quite as expected. His self-awareness is a good sign for Ethereum’s future.

- The Foundation has split their ETC. Have they sold it?

- He appears to imply that part of ETC’s problem is lack of credibility. He’s right, and that’s part of why I dumped my ETC despite being against that particular hard fork implementation.

- He’s also right that ETC would have done much better if it had (A) dual client ready, (B) decent block explorers, and © solutions for replay attacks. [Though ETH also should’ve had a solution for replay attacks.]

THE Dao Silver Lining: Improved Smart Contract Security

- Researchers from Microsoft, INRIA & Harvard published a paper on outlining a “framework to analze and formally verify Ethereum smart contracts.” It’s a relatively limited tool as it couldn’t read much of Solidity’s syntax, yet it could “translate and typecheck 46 out of the 396 contracts” found on the EtherScan block explorer.

- The scary part? “only a handful” were completely safe per this tool, thus “large scale analysis of published contract is likely to uncover widespread vulnerabilities.” Maybe. Given the tool’s limitations, I could definitely see a very real possibility that the contracts that their tool analyzed were old or contracts where not much money was at stake.

- Bottom line: The silver lining to TheDAO is that lots of smart minds have been drawn to making sure that smart contracts can and are written securely.

Quick hits

- Building a (fun) game on Ethereum. A surprisingly great read, even though I almost closed the tab after a few seconds. Constraints produce innovation!

- So you want to learn to code in Ethereum.

- Ethplorer. The first Ethereum Token Explorer. The existing Ethereum block explorers are great, but if dapps take off, then the token explorer is where it’s at.

- Chronicled – An Open Registry for the Internet of Things, built on Ethereum.

- A Proof of Concept on decentralizing Kindle

- Alex van de Sande released a proposal for a name registrar. It makes sense, but is not super simple.

- A new release of Mist Wallet included some nice features. In particular, Ethereum had a problem: how do noobs get a small amount of Ether to mess around? Solution: Mist integrates with Coinbase for a daily $5 buy. This caused some understandable controversy that the Foundation wasn’t being neutral. Reasonable criticism, but also great it’s easier to buy ETH for new folks.

- At a conference, Joe Lubin drops an anecdote about how “one of the leadership of one of the main exchanges in our space basically had the idea to start buying Ether Classic very early on” because it’s better than all the other scamcoins of its ilk. When I heard this, it felt like something clicked.

- Solid Bloomberg piece, but a bit on the hype side: This Is Your Company on Blockchain.

Dates of note

- 8/29 – Hong crowdsale begins. Similar to TheDAO in concept.

- 8/31 – TheDAO attacker can move his Ether Classic. Expect ETC price to drop.

- 9/1 – VCAPs (movie) crowdsale closes

- 9/7 – RexMLS crowdale closes

- 9/9 – SingularDTV crowdsale opens

- 9/19 – 9/21 – DevCon2 (!!!)

- 9/26 – eSports First Blood crowdsale begins

- September – TBA Golem crowdsale begins

[I’m not super excited about any of these crowdsales at the moment. I’ll get more into individual crowdsale analysis next week.]

Did someone forward this email to you? Sign up to receive the weekly email.